Savings Bond Wizard For Mac

. Choose Investing menu Security List, and then click New. Enter a meaningful name, such as US $1000-6% 01/24 for the purchase of a E/EE U.S. Savings Bonds, with a face value of $1000 and a maturity date of 1/20/24.

If you have more than one savings bond, make sure the name you enter here is unique. Click Add manually. In the Security Type list, select U.S. Savings Bond. Click Next and follow the on-screen instructions.

Quicken may not display all the fields described below, depending on the information you enter. Asset Class: Select Domestic Bond. Maturity Date: Enter the maturity date. Notes This procedure adds the savings bond to your Security List but does not track how many bonds you own.

To track your holdings, enter a buy transaction in one of your Quicken investment accounts. When you do this, keep in mind that U.S. Savings Bonds are tracked according to their cost per single bond-unlike corporate, Treasury, or municipal bonds, which are tracked according to share values derived from the bond's face amount. For a savings bond, you enter:. Number of bonds you bought (or own). Cost per bond (not the total cost of all bonds). Choose Investing menu Security List, and then click New.

Enter a meaningful name for this bond, for example, U.S. Treasury Note-6.50% 4, where 6.50% is the coupon rate and 4 is the maturity date. Click Add manually. In the Security Type list, select Bond.

Click Next and follow the on-screen instructions. Quicken may not display all the fields described below, depending on the information you enter. Asset Class: Select either Domestic Bond or Global Bond. Bond Type: Select the appropriate type of bond, such as U.S. Treasury Bill, Note, or Bond or corporate bond. Maturity Date: Enter the maturity date.

Call Date: Enter the call date, if your bond has one. Notes This procedure adds the bond to your Security List but does not track how many bonds you own. To track your holdings, enter a Bonds Bought transaction in one of your Quicken investment accounts.

When you do this, keep in mind that Treasury, corporate, and municipal bonds are tracked according to share values derived from the bond's face amount. Thus the price you enter, and the number of shares Quicken displays in the Portfolio will be different from what you see for other security types. In Quicken, you simply enter the number of bonds and the price per share. Quicken calculates the principal amount for you. Face amount: The Face amount is a multiple of 1,000.

This may be called Quantity on your brokerage statement. The face amount is 1000 times the actual number of bonds you own, or a hundred times the number of shares.

The face amount is used in order to match the way bond prices are quoted. In the Portfolio, Quicken displays the actual number of shares (ten times the number of bonds). Price: The price of a share is expressed as a percentage of the face amount, using a base of 100. If you pay $90 per share, you are paying 90 percent of the bond's face amount. If you pay $900 for the bond, enter $90 per share. Principal amount: This equals the face amount times the price expressed as a percentage.

Let's say you buy 20 bonds with a face amount of $20,000. The price per share is $90 (expressed as a percentage of the bond's face value, this would be 90%, or 0.90). Therefore, your principal would be $20,000 times 00.90, which equals $18,000. Recording a transaction in Quicken does not execute a real-world trade, transfer, or other transaction. Contact your broker to execute trades or transfers, and then manually record the transactions in Quicken-better yet, download them directly from your participating financial institution. Monitoring alerts, data downloads, and feature updates are available through the end of your membership term.

Online services require internet access. Third-party terms and additional fees may apply. Phone support, online features, and other services vary and are subject to change.

14,500+ participating financial institutions as of October 1, 2018. Standard message and data rates may apply for sync, e-mail and text alerts. Maaike cafmeyer getrouwd.

Savings Bond Wizard For Imac

Visit for details. Quicken App is compatible with iPad, iPhone, iPod Touch, Android phones and tablets. Not all Quicken desktop features are available in the App. The App is a companion app and will work only with Quicken 2015 and above desktop products.

Quicken Bill Pay (Bill Payment Services provided by Metavante Payment Services, LLC) is included in Quicken Premier and above and is available on as a separate add-on service in Starter and Deluxe. 15 payments per month included in Premier and above. Purchase entitles you to Quicken for 1 or 2 years (depending upon length of membership purchased), starting at purchase. Full payment is charged to your card immediately. At the end of the membership period, membership will automatically renew every year and you will be charged the then-current price (prices subject to change). You may cancel before renewal date.

For full details, consult the Quicken Membership Agreement. You can manage your subscription at your My Account page. Quicken 2019 for Windows imports data from Quicken for Windows 2010 or newer, Microsoft Money 2008 and 2009 (for Deluxe and higher). Quicken 2019 for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. 30-day money back guarantee: If you’re not satisfied, return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less shipping and handling fees. See for full details and instructions. Quicken for Mac software and the Quicken App are not designed to function outside the U.S.

The VantageScore provided under the offer described here uses a proprietary credit scoring model designed by VantageScore Solutions, LLC. There are numerous other credit scores and models in the marketplace, including different VantageScores. Please keep in mind third parties may use a different credit score when evaluating your creditworthiness. Also, third parties will take into consideration items other than your credit score or information found in your credit file, such as your income.

VantageScore®, Equifax®, Experian® and TransUnion® are registered trademarks of their respective owners. All 2018 and newer versions of Quicken entitle users to 5GB of free Dropbox storage while subscription is in effect. EQUIFAX is a registered trademark of Equifax Inc. The other Equifax marks used herein are trademarks of Equifax Inc.

Other product and company names mentioned herein are property of their respective owners. Portfolio tracking included with Quicken Premier and Quicken Home & Business on Windows. Payment links are only available for Quicken Premier and Home & Business. Illustrations © Adam Simpson.

All rights reserved. © 2018 Quicken Inc. All rights reserved. Quicken is a registered trademark of Intuit Inc., used under license. © 2018 Quicken Inc.

All rights reserved. Quicken is a registered trademark of Intuit Inc., used under license. IPhone, iPod, iPad Touch are trademarks of Apple Inc., registered in the U.S. And other countries. Android is a trademark of Google Inc.

Dropbox, PayPal, Yelp, and other parties’ marks are trademarks of their respective companies. Terms, conditions, features, availability, pricing, fees, service and support options subject change without notice. Corporate Headquarters: 3760 Haven Avenue, Menlo Park, CA 94025.

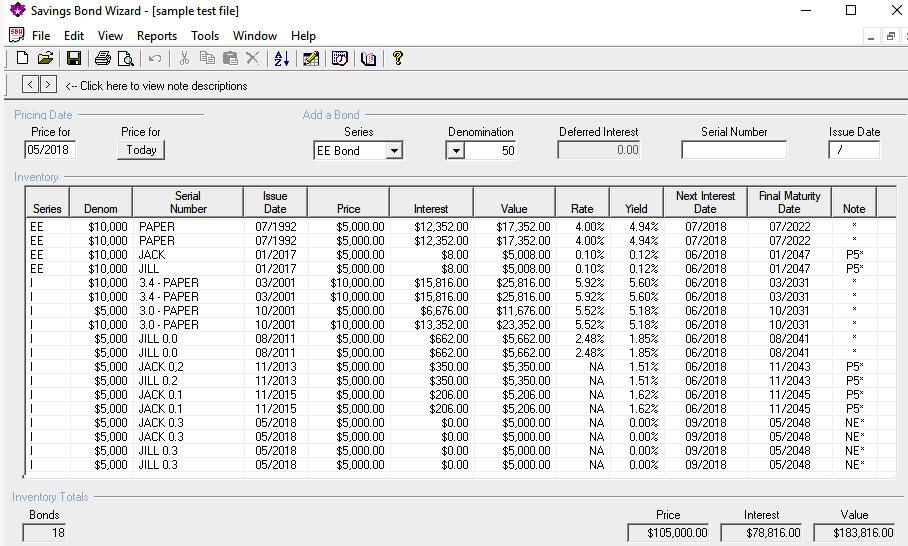

Step 1 Go to theTreasuryDirect website and navigate to the TreasuryDirect Calculator page. Once there, click on the 'Calculate the Value of Your Paper Savings Bond'(s) link. This takes you to the 'Calculate the Value of Your Paper Savings Bond(s)' calculator. Step 2 Click on the 'Value as of' box and enter the date you want the interest calculated through. Enter the month and date. For example, you can enter November 2012 as 11/2012.

Click on the 'Series' box to bring up 'EE Bonds, I Bonds, E Bonds and Savings Notes' selections. Choose the bond series you want calculate the interest for and click on it.

Step 3 Move to the 'Denomination' box and click on the drop-down menu. Select the denomination amount that is printed on the bond’s face.

Information for the next box, 'Bond Serial Number,' is optional. You don’t have to fill in the information for the calculator to work. Enter the issue date printed on the face of the bond in the 'Issue Date' box. Enter the month and date.

Step 4 Click on the 'Calculate' button to get the bond redemption amount for the date you entered in the 'Value as of' box. The 'Calculator Results for Redemption Date' will show the bond’s purchase price as 'Total Price;' the bond’s Total Value based on the date you entered; the Total Interest earned; and the YTD (Year-to-Date) Interest earned. Step 5 Click on the blue 'Calculate Another Bond' link to find the value of the next bond. The calculator will keep a running total of your bonds as you enter each one.

Copyright © Zacks Investment Research At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm. Visit for information about the performance numbers displayed above.

Us Savings Bond Calculator Wizard For Mac

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.